Fusion of New Dynamics: Bamboo Digital Technologies Debuts Industry Finance Solutions at the 2026 Asian Financial Forum

The 2026 Asian Financial Forum (AFF) was held in Hong Kong, China, from January 26 to 27. Co – organized by the Government of the Hong Kong Special Administrative Region and the Hong Kong Trade Development Council, the forum’s theme was “Collaboration in a Changing Landscape, Winning in a New Landscape,” with the new slogan […]

Read MoreSay Goodbye to Blind Marketing: Bamboodt Drives Deterministic Growth with Smart Closed-Loop Solutions

In an increasingly competitive market environment, financial institutions and payment companies are generally facing the challenge of “cost reduction and efficiency enhancement.” The rising cost of customer acquisition, stricter compliance and regulatory requirements, and the impact of emerging business models such as digital banks, e-wallets, and super apps, force them to achieve more efficient operations […]

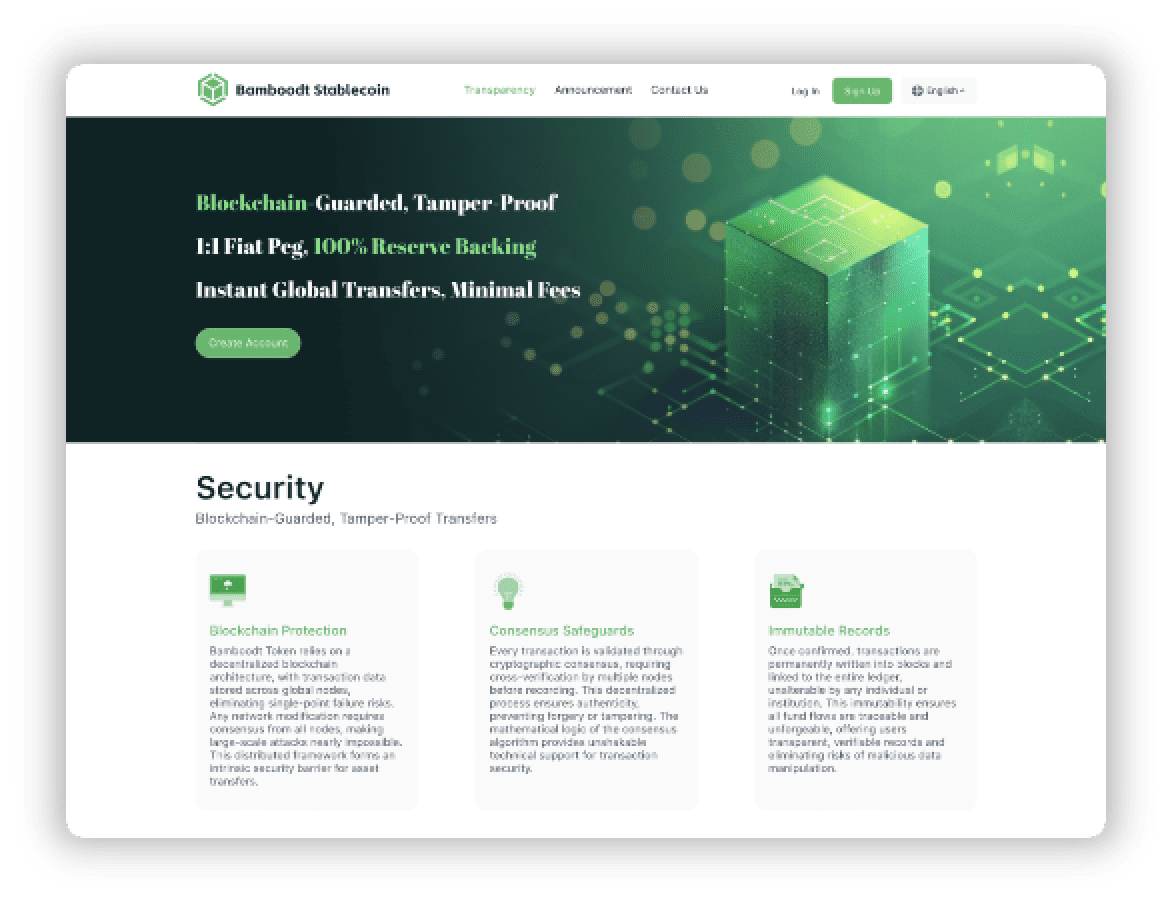

Read MoreBamboodt’s “Stablecoin Issuance Product” is officially launched

Code is the universal language of the intelligent era. We use code as a bridge to connect finance with scenarios and build a digital consensus for payments. Over the past decade, the cryptocurrency market has experienced severe fluctuations, which have always plagued the healthy development of the industry. Mainstream tokens such as Bitcoin, due to […]

Read MoreCollaboration for Win-Win: Bamboodt and Efficiencie Sign Strategic Cooperation Agreement

On October 16th, Beijing time, Bamboodt and Efficiencie officially signed a strategic cooperation agreement at Bamboodt’s headquarters in Beijing. Both parties, aiming for “win-win cooperation and building a new financial ecosystem,” have established a comprehensive strategic partnership, aiming to deepen the development of fintech and digital transformation in Africa through resource integration and innovative collaboration. […]

Read MoreHidden Bombs in Payment Security: Exposing and Combating Synthetic Identity Fraud

Synthetic identity fraud is a rapidly growing form of financial crime that poses a serious threat to the security of digital payments. Unlike traditional identity theft, which involves stealing an existing person’s identity, synthetic identity fraud creates new, fake identities by blending real and fabricated personal data. These fraudulent identities often appear legitimate on paper […]

Read MoreDigital Banking Profitability and the Super-App Endgame in Emerging Markets

Introduction Digital banking has exploded onto the scene in emerging markets across Southeast Asia and Africa, promising greater financial inclusion and convenience. However, many digital banks are struggling to turn a profit, raising questions about their long-term viability. At the same time, super-apps – all-in-one platforms offering everything from payments to ride-hailing – have become […]

Read MoreeWallet – Key Opportunities for Payment Finance Enterprises and Startups

Introduction eWallet – also known as eWalletts – have become a transformative force in the financial landscape of emerging markets. By allowing users to store payment information and make transactions via mobile devices, eWallet act as a bridge between traditional cash and modern digital finance. In regions like Southeast Asia and Africa, where large portions […]

Read MoreB2B Payments in Africa and Southeast Asia: The Rise of Stablecoins

Challenges in Current B2B Payment Systems High Costs and Fees Traditional B2B payments often involve multiple intermediaries (banks, correspondent banks, payment processors), each charging fees along the way. Cross-border transfers are especially expensive – banks commonly levy SWIFT transfer fees, currency conversion markups, and hidden charges that can significantly eat into a business’s profits. For […]

Read MoreFrom “People Seeking Services” to “Services Finding People”: How Bamboodt Smart Marketing Reshapes Bank Customer Experience

Globally, bank customers are no longer content with purely transactional relationships. They seek personalized, intuitive, and experience-driven interactions that add tangible value to their financial lives. This demand for more sophisticated engagement is significantly amplified in Southeast Asia and Africa. The rapid adoption of digital technologies and a pervasive mobile-first mindset in these regions mean […]

Read MoreThe Unseen Power in Your Payments – Why Digital is Non-Negotiable

In the vibrant and rapidly evolving markets of Africa and Southeast Asia, businesses—from large financial institutions and banks to burgeoning merchants—constantly grapple with the dual pressures of managing operational costs and enhancing efficiency. Traditional, often manual, payment processes present significant pain points: the administrative burden of paperwork, the inherent risks and high costs associated with […]

Read More